How to Build a Budget That Works for You

In this article, we provide a step-by-step guide to building a budget that fits your needs and helps you achieve your financial goals. From setting up spending categories to adjusting your budget as your financial situation changes, we cover all the essentials for creating a realistic and sustainable budget.

Price Comparison: How to Find the Best Deals for Everyday Purchases

This article explores various price comparison tools and techniques to help you make informed decisions when shopping. Learn how to compare prices across multiple retailers and online platforms to ensure that you’re always getting the best deals on the items you need.

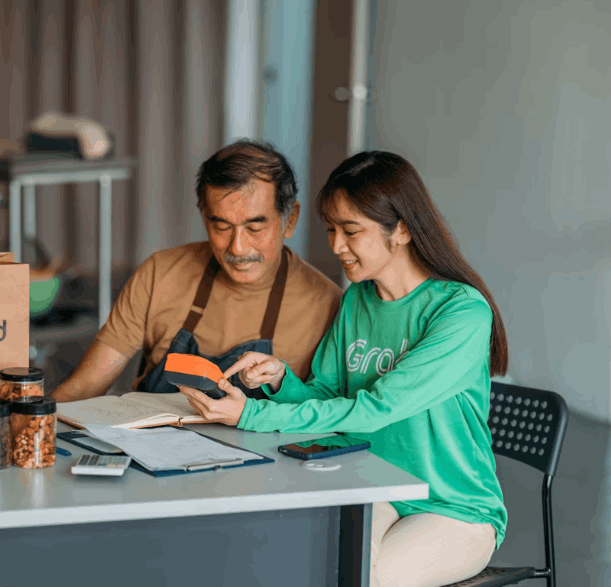

How to Track Your Spending and Manage Your Expense Report

Tracking your spending is crucial for maintaining financial health. This article outlines the best methods for monitoring your daily expenses and creating an expense report that provides clarity on where your money is going. By analyzing this report, you’ll be able to make adjustments to improve your expense management.

Reducing Unnecessary Subscriptions and Cutting Back on Recurring Expenses

Many people forget about their recurring subscriptions until they see the charges on their credit card bills. This article teaches you how to identify unnecessary subscriptions and offers tips on how to reduce or eliminate them, helping you optimize your expense management and free up money for more important financial goals.